House Prices – Rise or Fall ?

House Prices – Rise or Fall ?

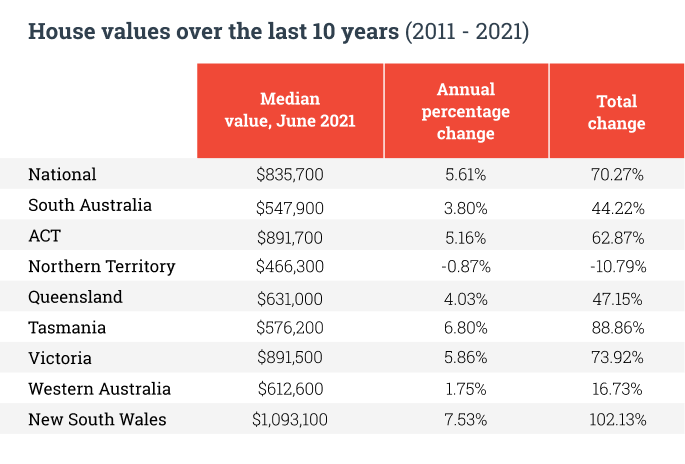

Lets put property prices in perspective and show some data .

If we look at the last 10 years property prices have performed quite modestly.

New South Wales and Tasmania have both exceeded the national average growth of 5.61 % per annum.

Victoria is in third place with annual growth of 5.86%.

Property prices in NSW doubled in the last 10 years and Victoria 73.92% higher.

The property price chart shows combined house and unit data.

If we break down this data , houses have been the star performer and out performed units.

This has continued into the second half of 2021 and in the first quarter of 2022.

Because both metropolitan and regional house prices have grown by 20% plus in many capital cities in 2021. For this reason we will see house prices plateau over the short to medium term, at least until consumer confidence returns.

I would be surprised to see prices of houses fall sharply without mortgage stress, very low stock levels and unemployment of less than 4%.

House vendors have retreated , particularly those of the higher price variety.

The stock left tends to be secondary and investment property which is lower priced.

We will see a much larger number of lower priced secondary and investment stock on the market and when this occurs the median price is corrected downward.

It does not mean that all house prices have fallen by that amount.

it just means there have been fewer higher priced properties sold during a month or quarter which can skew the median price.

The opportunity is in the older style flats and units over the next 12 months.

Growth in this market has been quite flat over the last 5 years and has not keep pace with house price growth.

Accordingly, as these older style flats are usually well located , I expect to see more growth or catch up in this asset , compared to houses over the next 12 months.